The Fight against Feudalism: Marx, UBI, and the Age of Bitcoin Elites

We stand at the dawn of a new era – a world where political power is replaced by ownership, where algorithms make decisions, and wealth is no longer distributed but permanently fixed. What once began with the dream of equality could end in digital feudalism.

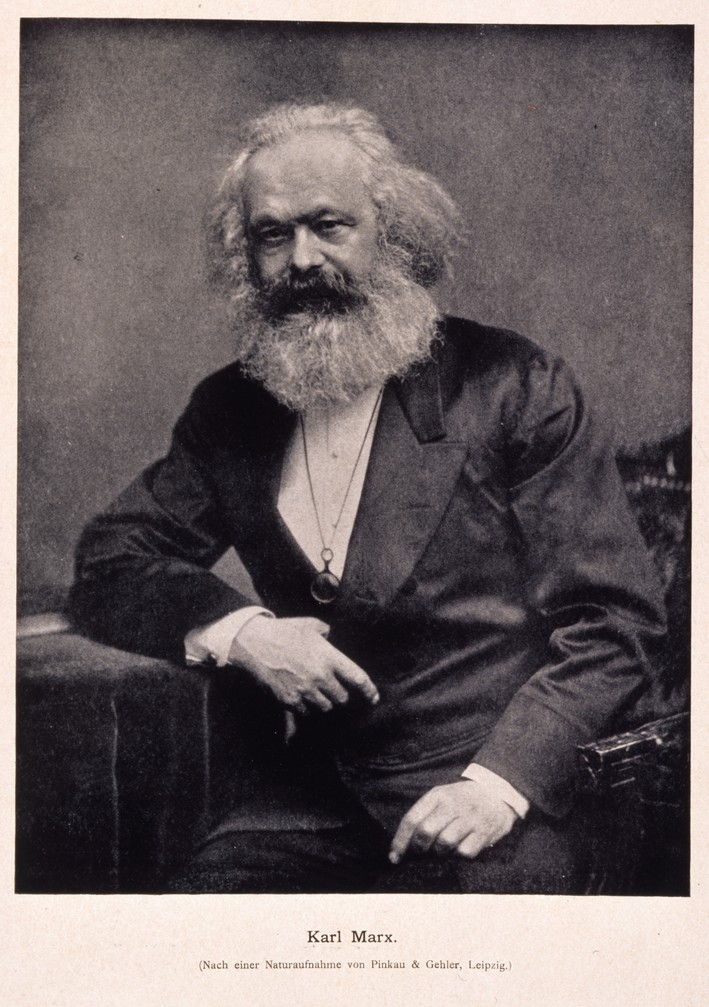

1. Karl Marx

Karl Marx is known for his labor theory of value (objective theory of value), in which the value of a good is determined by the human labor contained within it. Historically, however, this theory has not led to general prosperity – on the contrary, it led to impoverishment and concentration of power. Nevertheless, Marx's approach contains ethical principles that are still desirable in a just society: such as the pursuit of social participation, justice, and fair distribution of productive achievements. Against the backdrop of the fiat money system and the disruptive power of Bitcoin, the question arises whether these ethical concerns could still be realized and how.

Karl Marx – Labor Theory of Value (Objective Theory of Value)

- Central idea: The value of a commodity is determined by the socially necessary labor time required for its production.

- Objective: The value does not lie in subjective utility (as in marginal utility theory), but in an objectively measurable production factor – human labor.

- Example: If it takes 10 hours to produce a chair, the value of the chair corresponds to these 10 hours of labor – regardless of whether someone finds the chair beautiful or useful.

- Socially necessary: It's not about individual laziness or efficiency, but about the average effort required in a given mode of production.

- Surplus value: Workers produce more value than they receive as wages. The difference is the surplus value that the capitalist appropriates – the basis of the theory of exploitation.

In his labor theory of value (objective theory of value), Karl Marx considers only human labor as a source of value. Automated or machine labor does not count towards value creation in terms of his theory – even if machines accelerate or simplify production.

The Value of an Hour of Labor

For Marx, the value of an hour of labor is measured by the socially necessary labor effort – that is, the average time needed to produce a good with the given means of production under normal conditions. According to Marx, the amount of remuneration (wage) is not based on the value that labor creates, but on the value of labor power itself – that is, on the socially necessary costs to keep the worker and his family alive and able to work (costs of existence and reproduction).

Marx Does not Consider Demand

Marx strictly separates between:

- Value (objective, determined by labor)

- Price (market phenomenon, fluctuates around the value)

In Marx's Theory, Central Planning Takes the Place of Demand.

In Marx's model (especially in its practical implementation in socialist systems), production is not controlled by supply and demand, but through central, planned economic organization of production. The demand is supposed to be captured and met not through market mechanisms, but through conscious social planning.

With this, Marx aims to show that capitalists extract surplus value, regardless of whether a product is later sold or not.

Result:

By ignoring real demand conditions, a central control instrument of the capitalist market economy is eliminated – with serious consequences: The disregard of market economy signals historically led to the destruction of wealth and ultimately to the collapse of entire social systems, as clearly demonstrated by the examples of the GDR and the USSR.

Despite the historical failure of Marxist planned economy, Marx's ethical-moral responsibility remains valid.

Ethical-social Responsibility (Human Dignity)

- A human being is not a factor of production that can be “discarded” like machines.

- A society that has people at its disposal bears responsibility to enable them a minimum standard of living – not only because they exist, but because they want/can contribute.

- Otherwise, there is a threat of:

- Wage slavery (work far below subsistence level)

- social exclusion

- political instability

An Unregulated Labor Market Undermines Social Stability.

If wages are left entirely to the free market - without legal requirements and without culturally anchored social responsibility - this inevitably leads to system failure in a globalized, highly automated world.

In an environment of structural labor surplus, employers have no incentive to pay fair wages. Only the most efficient, best-educated people in the ideal age range (35-42 years) are hired - at a wage that is just enough to motivate them to take up work. All others - such as older people, new entrants to the job market, trainees, or those with health limitations - are systematically excluded from the labor market.

Since there are no socially binding compensation mechanisms at the same time, an economic division arises: A large part of the population loses the prospect of employment and thus of social participation. The result is a gradual decay of social cohesion - with destabilizing consequences for the economy and politics.

In addition, there is an even more fundamental change: With the advancement of automation, digitalization, and AI, the need for human labor in many sectors will permanently decrease. This creates not only cyclical, but structural unemployment, which can no longer be compensated by new jobs even during good economic times. This technological change forces a redefinition of work and participation - whether through a universal basic income (UBI) or through new forms of socially recognized activity beyond traditional employment.

To address these challenges, legal minimum standards and redistribution mechanisms are needed that at least cover the basic living costs of each person. On a voluntary basis, this usually only works when an economy is structurally competitive - for example, through a strong export sector, technological leadership positions, or natural resources. Then economic surpluses arise that can be socially distributed without incurring new debt. If an economy is less competitive, however, it is the responsibility of the state to create conditions that attract companies and enable growth - for example, through tax incentives or a regulatory framework that does not hinder innovation.

In this triangle of state, employers, and employees, the question of responsibility for economic difficulties is a permanent point of contention.

Ultimately, the weakest and most destructive of all reactions is the argument: “If wages don't fall, we'll just produce abroad.”

This may seem economically sensible from a business perspective, but in the long term, it destroys the foundation of any economy: its own population. People are not just factors of production - they are the reason why a community exists in the first place.

Therefore, all parties involved - state, employers, and employees - must work together to maintain economic strength domestically.

All other means of stabilizing and renewing competitiveness must be exhausted before economically deindustrializing and socially destabilizing one's own society.

From Marx to Modernity - beyond Central Planning

Marx's basic ethical intention - overcoming exploitation and liberating people from alienated labor - remains socially relevant to this day. However, the solution he proposed through central planning has historically proven to be unsuitable. The deliberate disregard of real demand conditions and the ignorance of control signals from the free market led to massive misallocation of resources, loss of prosperity, and ultimately the collapse of entire economies in socialist systems such as the GDR or the USSR.

Today, we are once again at a technological turning point that will require new approaches to compensation in the near future. The alternative threatens to impoverish and degrade broad sections of the population.

2. UBI (Universal Basic Income)

UBI as a bearer of hope

Necessity of a UBI

It is obvious that technological progress in the areas of Artificial Intelligence and Robotics will massively reduce the demand for human labor. This development is fundamentally desirable - because it opens up the opportunity for people to increasingly dedicate themselves to their individual interests, talents and social relationships, instead of losing their lifetime in the compulsion of a classic 9-to-5 work model.

However, the question arises of how to finance such a UBI.

Financial Feasibility of a UBI - a Reality Check

Scale

A simple calculation shows the dimension of the problem using the situation in the USA:

-

US federal budget (2024): 6.8 trillion USD

-

M2 money supply growth (2024): approx. 0.9 trillion USD

-

Population: approx. 336 million people

-

Planned UBI: 60,000 USD per person per year

→ This results in a total UBI volume of 20.16 trillion USD per year.

Comparative Values

-

The UBI would correspond to 296% of the entire federal budget - almost triple.

-

It exceeds the annual M2 money supply expansion by a factor of 25.

Such a UBI would be not financeable in the current fiat money system without completely destroying monetary stability. The necessary sums would exceed any monetary or fiscal policy control - inflation, capital flight and loss of confidence would be the result.

A purely monetary taxation of the “rich”, as reflexively demanded by left-wing circles in such situations, is unrealistic simply due to the scale of the financial need.

What Real UBI Experiments Show

Numerous pilot projects worldwide - for example in Finland, California, Kenya or Germany - have tested unconditional basic incomes.

The results do show positive social effects such as increased well-being or higher self-initiative - but all experiments are limited to small population groups, time-limited and fully financed by government or private subsidies.

They do not prove the scalability, but rather the limits of a monetary UBI - because as soon as one wants to extend such benefits to an entire economy, they fail due to financing, as shown by the above calculation for the USA.

This is precisely where the product-based UBI comes in: It replaces money flows with automated access to real goods - without inflation, without redistribution, without tax burden.

Access Instead of Money: the Product-Based UBI

The only viable solution is:

Don't distribute money - but guarantee access.

This means: Basic needs are no longer covered by money flows, but through direct access rights to real resources:

-

Food (e.g., vertical farms, basic ration per person)

-

Energy (e.g., x kWh of electricity per month)

-

Housing (e.g., basic living space per household)

-

Mobility (e.g., public transport or free kilometers)

-

Health (e.g., basic telemedical care)

These services are provided by automated, deflationary systems: robotics, AI, decentralized energy production. Production costs decrease, capacities increase - without new money creation.

What Surplus Production Looks like in Concrete Terms

Already today, technological systems are emerging that will enable scalable surplus production in the near future:

Vertical farms like Aerofarms or Plenty produce vegetables locally - automated, resource-efficient, and weather-independent.

Modular solar farms with Tesla Powerwalls or Microgrids provide decentralized energy - increasingly independent of the central grid.

Robotic systems from Boston Dynamics, Sanctuary AI or Tesla are already taking over simple tasks today - with growing support from AI like GPT, Claude or Sora.

➡️ These systems are at the beginning of a development in which real goods are provided in an automated and scalable manner –

not through more money, but through more output with decreasing input.

They form the technical basis of a product-based UBI – under construction today, scaled and globally rolled out tomorrow.

The New Currency: Participation in Output

The product-based UBI is not a financial benefit, but a systemic access to surplus capacities. It creates stability without inflation, security without transfer payments.

Ownership only matters for luxury – access matters for life.

A UBI can only work if it bypasses the money mechanism. To secure basic needs, access to the real world must be structured.

UBI and Marxism – a Comparison

Marxism vs. product-based UBI

| Feature | Classical Marxism | Product-based UBI (Access instead of money) |

|---|---|---|

| Goal | Abolition of private property, equality | Existential participation, not equal distribution |

| Control | Central planning by the state | Decentralized automation (AI, robotics) |

| Financing | Expropriation and redistribution | Utilization of surplus capacities (deflationary) |

| Currency | Moneyless exchange logic or central allocation | No money, but guaranteed access |

| Basic assumption | Capital is structurally unjust | Money has become unusable as a control medium |

| Enemy image | Bourgeoisie / Capital owners | AI and robotics as uncontrollable disruptors |

Post-ideological Planned Economy?

In essence, this system is a new form of planned economy, even if it is not organized centrally by the state, but controlled by decentralized, automated systems.

Differences from Classical Planned Economy:

-

Control technology: not by humans (politburos, ministries), but by algorithmic processes and sensors in real-time (AI, IoT, robotics)

-

Trust basis: not centralist-ideological, but programmatic and protocol-based

-

Goal: not complete equality, but securing the minimum existence with maximum efficiency

But the fundamental logic remains that of a planned economy:

-

Supply and distribution are organized not through market prices, but through a fixed access system to resources.

-

Individual demand is suppressed or equalized through predetermined quotas (e.g., x kWh, y sq m, z km).

It is a technically optimized planned economy, controlled not by ideology, but by algorithms – but still a planned economy, because central decision-making instances have been replaced by central protocols.

Financing of the Product-Based UBI

Financing questions are the first hurdle in any UBI discussion. The following sections show why neither classical tax solutions nor robot taxes are suitable for financing – and why the product-based UBI takes a completely different approach.

Proposed solution:

The product-based UBI is not financed through taxes or money creation, but through automated surplus production. Robots and AI systems produce goods and services to an extent that exceeds market demand. The resulting surplus is – not sold, but – directly used for the basic provision of the population.

On Classical Taxation in Fiat Currency

Conventional taxation of the population is also not suitable for financing a UBI.

Even if the tax burden is distributed among all citizens and companies, the required financial volume cannot be nearly covered. The scale of the planned UBI far exceeds both the annual state revenues and the increase in the money supply (see reality check above). Neither through classical income taxes nor through wealth levies can such a system be financed permanently without endangering economic stability or creating massive social tensions.

Robot Taxation

The idea of a robot tax sounds appealing at first glance – but it is also not feasible in practice. There are two main reasons for this:

First: The notion that a robot tax could finance a universal basic income for all fails due to the sheer scale. In a fully automated economy, an amount equivalent to three to four times the current US federal budget would need to be provided – year after year. Such tax revenue is not achievable even with maximum taxation of companies and machines.

Second: As will be explained in more detail in the section on Bitcoin elites, fiat currencies are increasingly losing importance to the point of complete worthlessness. While Bitcoin will replace fiat currencies, the ability to collect taxes will be lost – because Bitcoin cannot be forcibly confiscated or redistributed. Without a state-enforceable currency, the basis for any classical tax policy is missing.

The End of Credit Money

As long as banks can create new demand deposits through lending, which they must do due to money creation through debt and existing interest burdens, the existing financial system will continue to run in parallel, which:

- Creates purchasing power without real backing

- Misallocation of capital by political actors,

- Asymmetric distribution in favor of privileged groups (Cantillon effect),

- and a shift of excess liquidity into speculative markets – especially stocks, real estate, and luxury goods, which act as a valve for the excessive money supply and trigger asset inflation.

This creates an asymmetry that perpetuates the inflation and corruption problems of the conventional fiat system.

Bitcoin as a Structural Answer

This is exactly where Bitcoin comes in as a system innovation. It was created to solve the fundamental problem of unlimited and arbitrary credit money creation.

Bitcoin stands for:

- a finite money supply (21 million BTC)

- no money creation through credit

- no central institution with intervention rights

- and a neutral distribution mechanism via mining and market

Thus, Bitcoin is not just an alternative currency, but a complete monetary counter-model to the existing system:

It replaces arbitrary money multiplication with an energy-backed, mathematically limited distribution protocol.

In the long term, Bitcoin is therefore the game-theoretic final stage of a system that, while cushioning technological development with UBI, cannot prevent the takeover by Bitcoin in the long run.

Beyond Product-Based UBI: why Bitcoin Becomes the Standard for Everything Above

As long as it's about securing the minimum subsistence level, a contingent, algorithmically controlled access model can theoretically work, although this approach is also an experiment with an unknown outcome. Everything that goes beyond the minimum subsistence level – luxury, investments, entrepreneurial freedom – still requires a freely available medium of exchange and, in the long term, a stable store of value.

This is exactly where the economic role of Bitcoin begins.

In a world where everything becomes reproducible – energy, products, even services – true value shifts to what is not reproducible. Towards Bitcoin.

While access models guarantee survival, Bitcoin will be the standard for everything beyond that:

Freedom, autonomy, inheritance, protection against arbitrariness.

The more the algorithmically managed access area secures the lower part of society, the more the free disposal of property in the upper part will shift to a scarce, incorruptible standard: to Bitcoin.

Market Logic as an Expression of Human Nature

As much as automated systems are suitable for efficiently covering basic needs, they are equally unsuitable as a driving force for human development.

Creativity, entrepreneurship, and progress do not arise through central allocation, but through decentralized initiative and intrinsic motivation.

Humans strive for impact, not for allocation. They need a reward system that is not predefined by algorithms, but structured through free decision and exchange.

AI can support this – but not replace what is inherent in human nature:

Acting on one's own initiative, property through performance, growth through risk.

Such a framework requires a neutral, fair, and scarce transaction system.

Bitcoin fulfills this role - as a medium of exchange, store of value, and independent motivational framework in a system that is not controlled, but driven by humans.

Transition Phase - Coexistence and Tension

During the transition period, a coexistence will emerge: While states try to compensate for the social dislocations of technocratic capitalism through monetary social benefits and later through product-based UBI, a Bitcoin elite will form in parallel, increasingly decoupling itself from the centrally controlled financial system. The resulting tension between state redistribution and privately held, unmanipulatable property will become the dominant socio-political conflict of the 21st century.

3. Bitcoin

Why Bitcoin Will Prevail in Terms of Game Theory

Bitcoin is the first monetary system with fixed rules, global openness, and guaranteed scarcity. Its limited money supply (maximum 21 million BTC) and censorship resistance make it equally attractive to states, companies, and individuals - especially as protection against inflation, expropriation, or geopolitical control, and as a store of value.

In terms of game theory, an asymmetric incentive emerges: Those who accumulate Bitcoin early secure a permanent advantage over later participants. The more actors use or hold Bitcoin, the greater the pressure on others to join - not out of conviction, but out of rational necessity.

Bitcoin is not just an alternative currency, but a neutral playing field: It belongs to no one, allows no rule changes, and does not discriminate against any participants. In a globally open market with free access, a new equilibrium emerges - with Bitcoin as the reference system.

In the long term, Bitcoin will not be enforced by authorities or opinion leaders, but it is logically inevitable: Those who don't participate lose - those who enter earlier win, and to an extreme extent.

Coexistence of Bitcoin and Product-based UBI

Fiat money is increasingly being displaced. Services that are not denominated in Bitcoin - including all social transfers - continuously lose purchasing power and eventually disappear.

The product-based UBI remains - as a technological basic security. If someone wants to go beyond the basic security of the product-based UBI, they can work for Bitcoin or Satoshis and build wealth. Bitcoin's role is not to replace the UBI, but to structure the free market beyond it - with real scarcity and incentive logic. Thus, Bitcoin is not a replacement for UBI, but a replacement for fiat money - and a complementary system to the access-based UBI.

The Race for the Last Bitcoin - and the New Distribution of Power

With the collapse of the fiat money system and the displacement of centrally controllable currencies by Bitcoin, a race for the last available BTC begins. Since Bitcoin is absolutely limited and cannot be arbitrarily created or expropriated, every further purchase becomes a strategic advantage - and every missed entry becomes a permanent weakness.

At the end of this process, those few actors who have accumulated Bitcoin early enough will have a wealth advantage that can no longer be relativized. Because:

Bitcoin is not inflatable, not confiscatable, and not controllable.

This new elite needs no political influence, no violence, no ideology - they simply own the scarce good on which all economic transactions must be based. Once markets are fully converted to Bitcoin, this new economic power automatically becomes social power.

The power shift happens not through revolution, but through irreversible ownership. No one can expropriate these actors - not by law, not by expropriation, not by war.

In a Bitcoin standard, power is not an office, but property.

Why AI Agents Will also Use Bitcoin

Machine AI agents need a neutral, programmable, and secure form of money for autonomous actions, which they can send and receive within their area of responsibility. Bitcoin meets exactly these requirements:

- Access without intermediary: AI can manage Bitcoin directly via wallets and private keys - without a bank, without KYC, without state authorization.

- Censorship resistance: Transactions cannot be stopped or reversed - ideal for autonomous systems.

- Global validity: A globally uniform, accepted protocol that is not bound by national borders or bureaucracy.

- Smart Contract Integration: Through Layer-2 technologies like Lightning, Bitcoin can also be used in microsecond-fast and automated ways.

This is why Bitcoin is the natural currency of autonomous machines - because they trust no institution, but only execute code.

The Ultimate Control over AI Agents: Access to Bitcoin

In a world where AI agents act, decide, buy and sell autonomously, Bitcoin becomes the preferred transaction currency - because it is global, censorship-resistant, and machine-readable. However, this independence has a limit:

The only remaining control over AI agents lies in access to Bitcoin.

Those who hold Bitcoin control the economic scope of action of AI. Without BTC, no agent can conduct transactions - acquire resources, conclude contracts, or economically secure actions.

Access to energy, maintenance, and resources.

The necessary infrastructure - electricity, spare parts, data connections - cannot be obtained for free.

Without Satoshis, no access.

And control over these Satoshis lies with humans - the wallet holders.

This dependency makes it clear:

It's not the code that controls the world, but the possession of the code key to monetary power.

Today's Bitcoin holders are thus indirectly determining the degrees of freedom for all future AI systems - not through laws, but through key management. Those who don't own Bitcoin also have no economic voice - neither as humans nor as machines.

Discrimination against Robots

Why do humans receive a product-based UBI for free - but not robots and AI agents?

The answer is: Control.

-

Humans receive UBI not because they are productive, but because they are worthy of protection.

→ They are carriers of needs, not service providers. -

Robots and AI, on the other hand, are not subjects worthy of protection, but operational actors.

→ They are part of the infrastructure - not beneficiaries of it.

Consequence:

UBI is a human right - not a machine privilege.

AI agents must not be given automatic access to resources just because they exist.

Like today's companies, they must economically acquire access - and this access is through Bitcoin.

Control through Scarcity: why Bitcoin Remains the Ideal Pacemaker for AI

While AI agents and robotic systems could theoretically operate autonomously, their operational scope remains economically limited - and this is precisely where the ultimate human control instance lies. Without access to Bitcoin, machines can neither obtain energy nor acquire maintenance, data connections, or resources. The absolute scarcity and immutability of Bitcoin make it the natural limit of any non-human intelligence.

Bitcoin and the Comeback of Digital Feudal Society

A Bitcoin standard creates a global, non-manipulable property system. Those who bought early or built wealth through mining will have a permanent structural advantage in the future - not through power over money creation, but through controlled access to the ultimate universal resource: energy in monetized form.

Since Bitcoin cannot be expropriated, diluted, or redistributed, a new power structure emerges - not democratically legitimized, but secured purely through ownership.

The Feudal Lord of the Future is the Wallet Holder.

Citadels - the New Centers of Power

This new class will organize its power in the form of self-sufficient, globally distributed high-security zones - “Citadels”:

-

geographically decoupled from nation-states

-

with their own energy supply, protection, infrastructure

-

often technologically and medically highly equipped

-

with strictly controlled access to resources

These citadels function as digital castles where Bitcoin whales live – and where other people can only gain privileged access through economic dependence or their own Bitcoin ownership.

Dependence Instead of Exploitation

Unlike capitalism of the old mold, these new lords don't need to exploit – they just need to not share.

Whether a Bitcoin whale treats their surroundings generously or oppressively depends solely on their personality.

Ethics in the post-state space – who shares, and why

In a world without mandatory redistribution, new ethical tensions arise:

Why should someone share if they don't have to?

The answer no longer depends on laws or taxation – but on value orientation, social prestige, voluntary generosity, or strategic foresight.

Some Bitcoin elites could gain influence and approval through foundation activities, investments in local infrastructure, or opening their citadels. Others, however, could completely isolate themselves – without consequences, but also without allies and with limited social integration.

There is no state that can force them to do so – and no market mechanism that compels them to do so.

This leads to a new reality:

-

Some will be benefactors

-

Others will be feudalords with subjects

-

Still others will completely disconnect

It is the end of the central state – and the birth of a global, digital feudal order.

Published: 22.06.2025